Publicaciones principales

Wexo Points: Find places where you can pay with Bitcoin (App Up...

Search nearby businesses that accept Bitcoin payments

Leer másThe company behind the popular video game franchise Grand Theft Auto is entering the world of Web3 through its mobile games division. Mobile gaming giant Zynga is owned by Take-Two Interactive, which also owns Rockstar Games, the creator of popular video games such as Grand Theft Auto, Red Dead Redemption and NBA 2K.

Zynga, best known for its FarmVille franchise, has formed a new studio called Zynga Web3 (or ZW3) and announced a new game called Sugartown. It's a cross-media world that will resemble the Web3 platform rather than an individual title. The cute cartoon animals in the teaser video hint that there could be other projects in the pipeline, not just video games. The whole concept is reminiscent of a scene from a new series on Netflix, so it wouldn't be surprising to see a cartoon series featuring characters from Sugartown in the future.

For now, it's confirmed that Sugartown will introduce an NFT collection called Oras, which will be needed to participate in upcoming games within this universe. ZW3 has stated that the franchise is working with various communities to allocate franchises for NFT. If this platform does well, perhaps it could open the door for other big titles from the same company to enter Web3.

Bitcoin halving & spot ETF approvals to cause billions of inflows

The growing popularity of cryptocurrencies in the global market brings new challenges, but also opportunities. In a recent interview with CNBC, Anthony Pompliano, a prominent bitcoin investor and podcaster, pointed to the impending approval of spot bitcoin ETFs in the U.S., which could bring billions of dollars in inflows from institutional investors into the sector. "I'm confident that Bitcoin ETFs will be approved in the U.S., which will lead to billions of dollars of inflows," Pompliano said.

He wasn't alone in this opinion. Various events, such as the SEC regulator's court losses to Ripple Labs and Grayscale, suggest that the traditional financial system is beginning to accept cryptocurrencies. US Congressman Tom Emmer has spoken out strongly against SEC Chairman Gary Gensler in this regard. In a post on the X platform (which was once known as Twitter), Emmer criticised Gensler for his sceptical approach to cryptocurrencies. "While it remains to be seen how the pending litigation will conclude, it should be increasingly obvious to policymakers that the crypto industry is not as disagreeable as Gensler claims," Emmer said.

And what could all this mean for the future of Bitcoin? According to Pompliano, in line with Bitcoin's impending halving in April 2024, these events could cause a "demand shock" in the cryptocurrency's accumulation. "The closer we get to halving, we can expect a combined supply and demand effect that could significantly impact the price of Bitcoin, similar to 2020," he added.

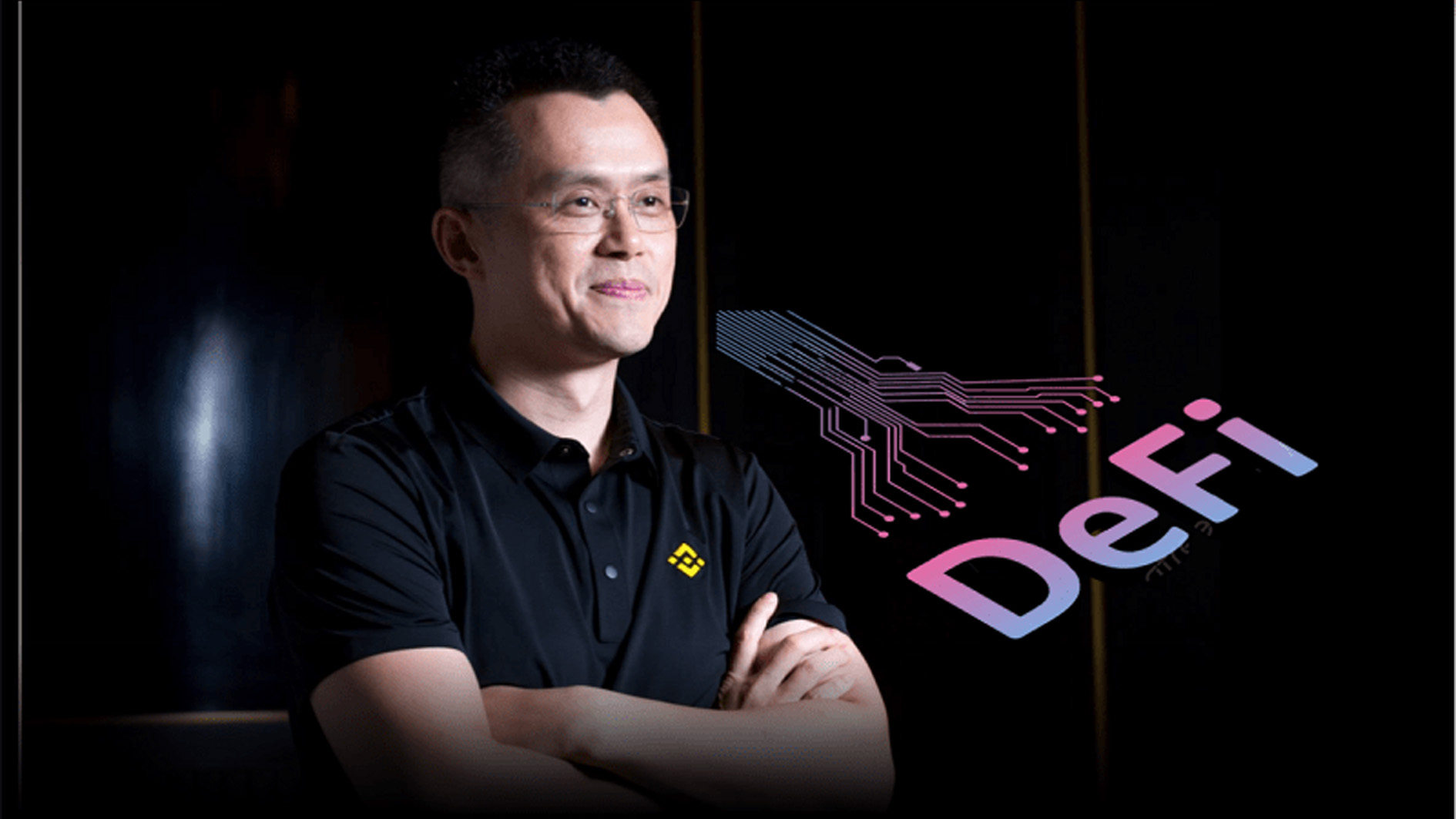

Binance CEO CZ forecasts DeFi will outgrow CeFi in the next bull run

Binance's CEO, Changpeng "CZ" Zhao, recently predicted that decentralized finance (DeFi) has the potential to surpass centralized finance (CeFi) in further market growth. During a recent live broadcast on the X Spaces platform, Zhao highlighted his vision for the future of DeFi. He stated, "DeFi is the future; the current volume is somewhere between 5% to 10% of CeFi volumes, which is not small... further growth could very easily make DeFi bigger than CeFi."

In line with this vision, this is supported by recent data showing that venture capitalists are shifting their funds from CeFi projects to DeFi projects. According to a March 1 report by CoinGecko, digital investment firms invested $2.7 billion in DeFi projects in 2022, a 190% increase from 2021. On the other hand, investment in CeFi projects fell 73% to $4.3 billion in the same time period. This "potentially points to DeFi as a new high-growth area for the crypto industry."

Zhao also expressed that he believes in the power of decentralization and sees it as key to the future of the crypto sector. He added that developers who write code for DeFi platforms should be protected because their work is akin to freedom of speech. In this regard, he said, "Developers write code, that code is free speech. That kind of development is really good."